Square - digital banking and network effects

Background

Square is split into two distinct business divisions, ‘Seller’ - a fully integrated payment, commerce, and business solutions technology platform, and ‘CashApp’ - a ‘digital wallet’ or a non-bank provider of financial services such as payments and banking to individuals and businesses.

Square’s products and services enable financial inclusion and economic participation, especially within the small business and underbanked communities. They offer low barriers to entry and relatable products and services that allow individuals and businesses to participate in the broader economy and get access to financial services. Square’s business lending division, Square Capital, provides funding to Sellers in its ecosystem to help run and grow their business with a skew to women (58%) and minority (35%) owned businesses.

CashApp has a similar impact on the unbanked and underbanked across the US, providing easy to access and relatable financial services. While CashApp is more broadly used, initially it was particularly popular in the underbanked southern states and in low-income communities that may have been overlooked by traditional financial institutions as being unprofitable.

Seller Ecosystem

Square has developed a competitive moat through its integrated ecosystem of products and services, which they continue to innovate and enhance, increasing functionality and ultimately user adoption. This has created a network effect as sellers and individuals use more services, their activity with Square increases, increasing seller retention and recurring revenue.

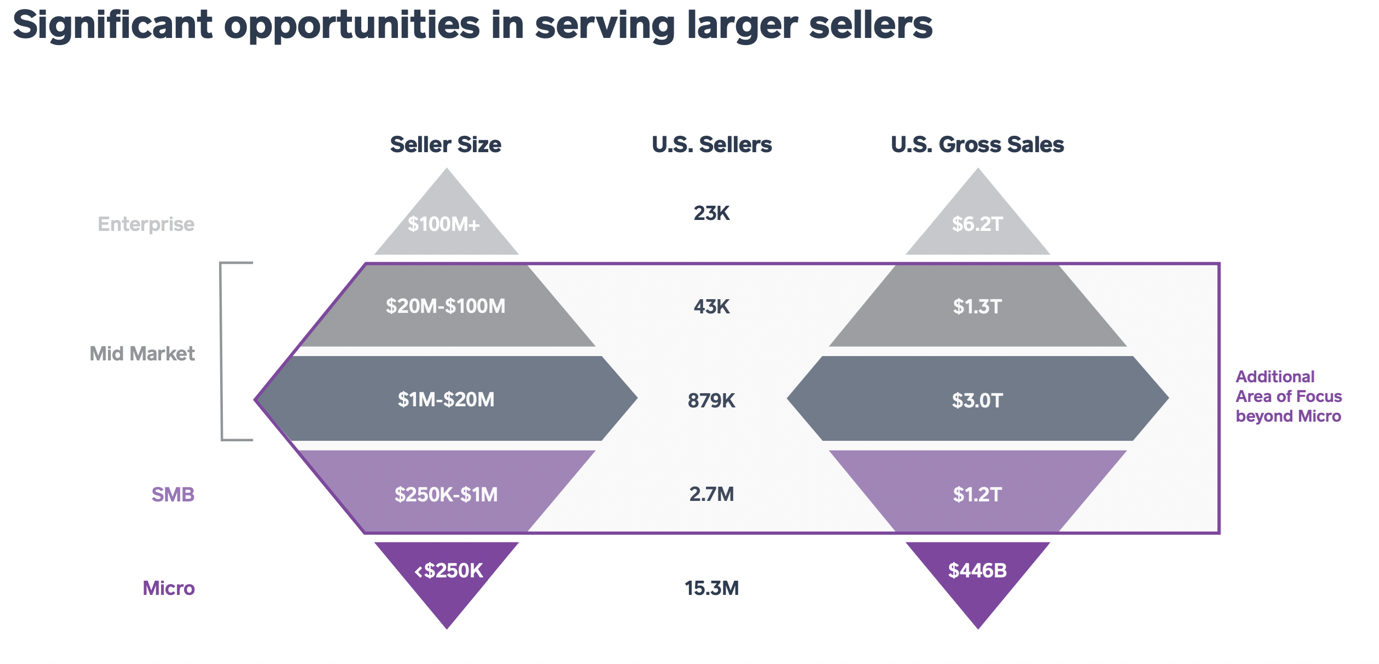

The increased functionality of the ecosystem has allowed Square to, more recently, target and attract the considerably larger Mid-Market segment. As an example, Square recently introduced industry specific functionality, Square for Restaurants and Square for Retail, which has helped them attract new and larger clients. What they have observed is that these clients have typically used more services of their broader ecosystem, and generated gross profit ~ 5x greater compared to the average seller.

The expansion into the Mid-Market segment is seen as a significant growth opportunity and in Q121 gross payment volumes (GPV) in the mid-market segment grew 43% year on year, more than 2x the growth of total Seller GPV. As the Mid-Market segment dwarfs the Micro and SMB markets, it will considerably increase Squares total addressable market (TAM). Square estimates that following this shift, the TAM for the combined segments of payment processing, business software and lending within its ‘Seller’ division, to be ~US$85 billion in the US and over $100 billion globally, of which it has <3% penetration.

CashApp

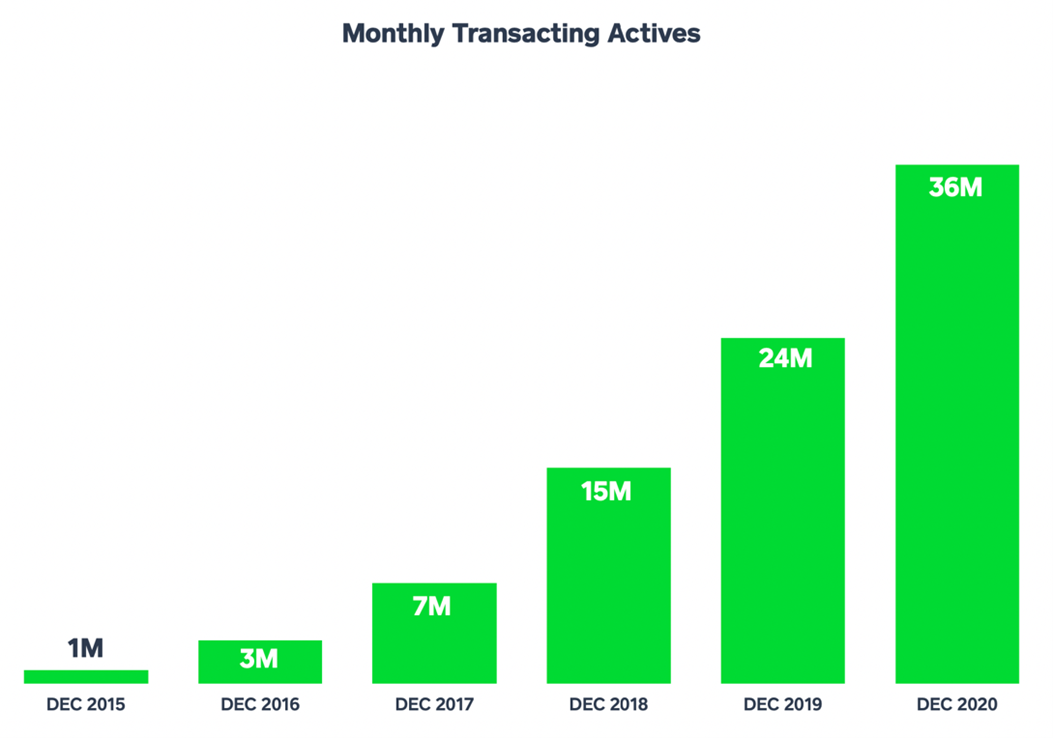

Simplistically, CashApp is a peer-to-peer (P2P) payments network that allows users to send, spend and invest through a digital wallet. It has a strong competitive advantage compared to traditional financial institutions through the low customer acquisition costs it enjoys due to P2P network effects. The increased functionality of the ecosystem has driven user engagement and higher customer lifetime value with the introduction of its CashCard, Boost Loyalty program and investment services for trading shares and bitcoin. CashApp has seen strong growth over the past four years growing 10x, and up 50% in CY2020 to 36M monthly active users.

CashApp has a tremendous revenue opportunity, estimated to be US$60 billion, from its send, spend and invest functionality, by becoming the primary banking and financial services platform for its large and growing user base. Most of the market opportunity (~$40 billion) lies in the spend functionality through the transaction fees earned from Cash Card transactions. Currently the bulk of CashApps revenue come from P2P ‘send’ transactions but the company has demonstrated that by graduating customers to their Cash Card they can drive a meaningful increase in revenue in the target ‘spend’ segment.

We believe Square will continue to democratise financial services and grow its TAM as it innovates and expands its product offering. Its CashCard product for example, now has 10 million ‘actives’ which is up 2x year on year and is a key revenue driver.

Conclusion

Square has many of the attributes we look for in a long-term investment including a market leadership position, strong network effects from its ecosystem, and a large TAM, and these are present across both its core Seller and CashApp divisions

Square’s highly effective, low barriers to entry and innovative technology platform is expected to continue to grow its share of the very large TAM that it serves, currently estimated to be US$100 billion for Sellers and $60 billion for CashApp. With one of the lowest customer acquisition costs and strong network effects present in its core divisions, we believe Square has an enduring competitive advantage relative to industry incumbents. As Square has <3% market share in its respective operating segments, we see a long runway for growth.

This note has been prepared by ELM Responsible Investments (‘ELMRI’) ABN 70 607 177 711 AFSL 520428, for Australian wholesale clients for the purposes of section 761G of the Corporations Act 2001 (Cth).

The information is not intended for general distribution or publication and must be retained in a confidential manner. Information contained herein consists of confidential proprietary information constituting the sole property of ELMRI and its investment activities; its use is restricted accordingly.

This note is for general informational purposes only and does not purport to be comprehensive or to give advice. The views expressed are the views of the writer at the time of preparation and presenting and all forecasts, assumptions, opinions, data and other information are not warranted as to accuracy or completeness and are subject to change without notice. This is not an offer document and does not constitute an offer or invitation of investment recommendation to distribute or purchase securities, shares, units or other interests to enter into an investment agreement. No person should rely on the content and/or act on the basis of any material contained in this note. Any potential investor should consider their own circumstances and seek professional advice.

ELMRI funds, its directors, employees, representatives and associates may have an interest in the named securities.

Past performance is for illustrative purposes only and is not indicative of future performance.