Investment case for Eroad

Background

Eroad is a New Zealand based software fleet management and telematics company with operations in New Zealand, Australia and North America. Their products enable fleet managers and drivers to improve safety, streamline business operations, improve efficiency and improve profitability for trucks and other assets. The company has been listed in New Zealand for a while, but has only been listed in Australia since September 2020.

The company has many attributes we look for:

Large and growing addressable market

According to McKinsey the global telematics industry is expected to reach $750 billion by 2030 as countries look to solve their transportation problems, alleviate road congestion and make their roads safer.Recurring revenues

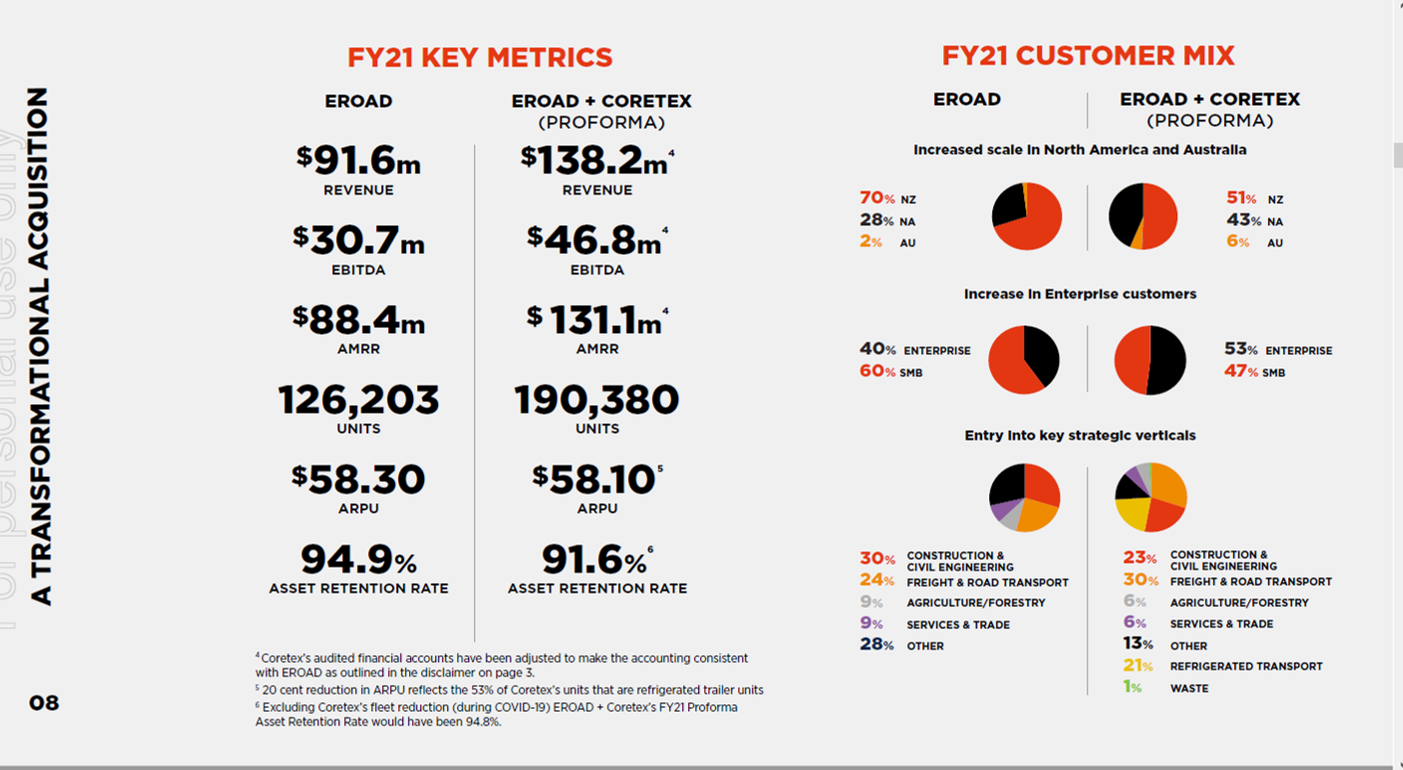

The company’s devices are installed in customers’ trucks, utes and other assets and Eroad receives a recurring revenue stream. As of FY21, average revenue per user (ARPU) was $58.30, annualised monthly recurring revenue (AMRR) was $88.4m and retention rate was 94.9%.High margins

The company’s EBITDA (earnings before interest tax and depreciation) margin was 33.5% in FY21. Due to the hardware, margins are lower than those of pure software companies.Aligned management team with experience

The company is led by long serving and aligned CEO Steven Newman.

As you can see from the chart below, the company has seen consistent growth in total contracted units since 2014 and as of 1H2021, the company had over 122,000 units contracted. More recently, as of June 2021, the company has over 130,355 units as well as 2,984 of their recently launched Dashcam.

Coretex Acquisition

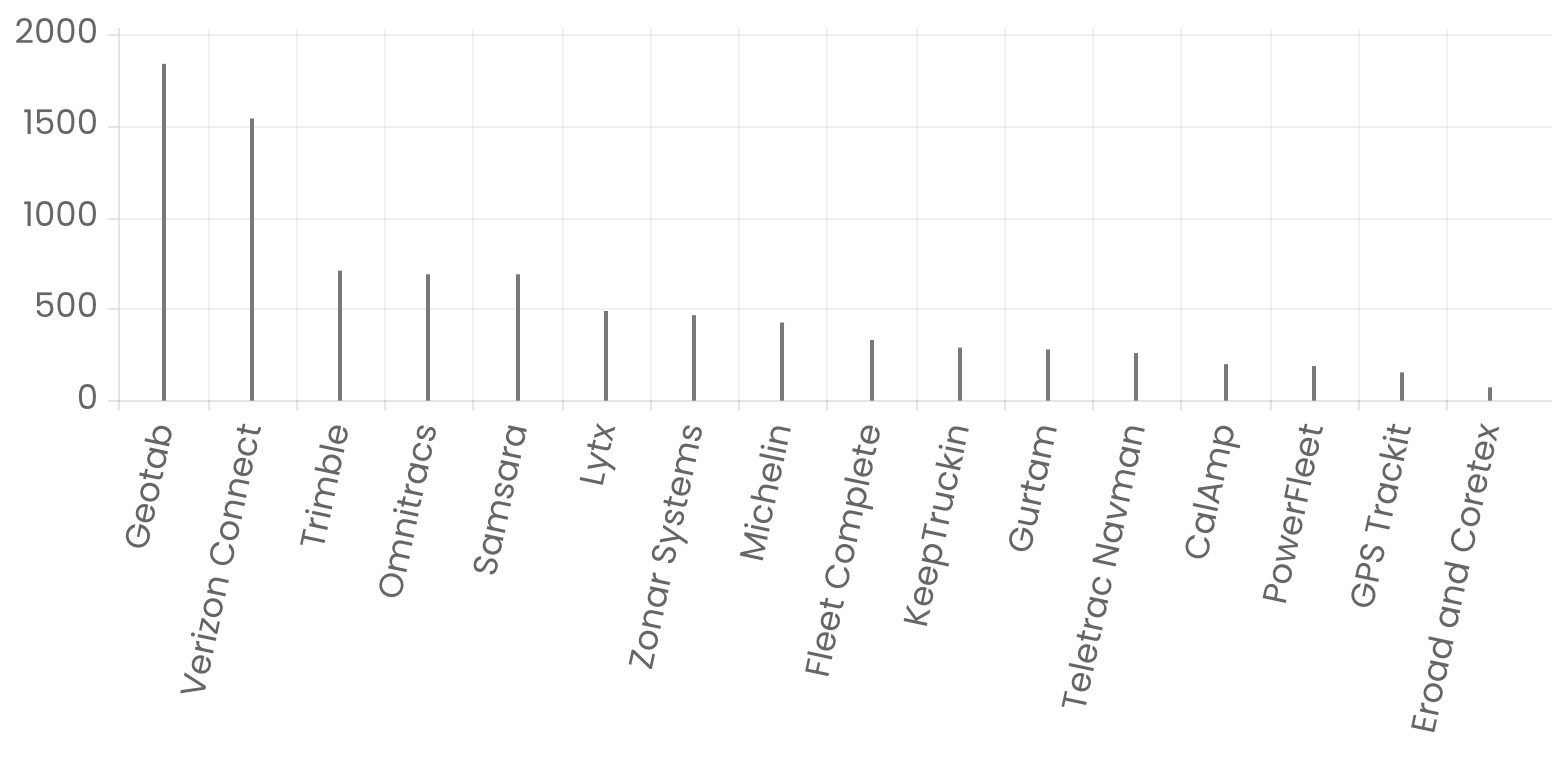

In July, Eroad announced the acquisition of Coretex, a New Zealand based quasi-competitor with a presence also in New Zealand, Australia and North America. They will pay $157.7m upfront and $30.6m payable in FY23 all funded by the issuance of new equity. $96m of Eroad shares will issued to Coretex shareholders, and up to $92.3m will be paid in cash. Coretex is expected to deliver AMRR of between $50-$53m and EBITDA of $7-9m in FY22, which equates to 3.65x FY22 AMRR and 23.5x FY22 EBITDA. The acquisition will help accelerate the growth and presence in North America, increase exposure to enterprise customers and provide exposure to other verticals such as refrigerated transport and waste. They will still be a minnow in North America however (see chart below).

Although there is execution risk with all transactions, we are comforted by the fact that the CEO has committed to invest $3m into the capital raise.

Combined Business Metrics

Key Market Participants by Number of Installed Units in Australia and New Zealand

Eroad Independent Report 2021

Key Market Participants by Number of Installed Units in Americas

Eroad Independent Report 2021

Growth Opportunities

Eroad’s two key value drivers that are crucial to generate revenue growth for the company are:

The number of users (currently 126,203)

Average revenue per user (currently $58.30)

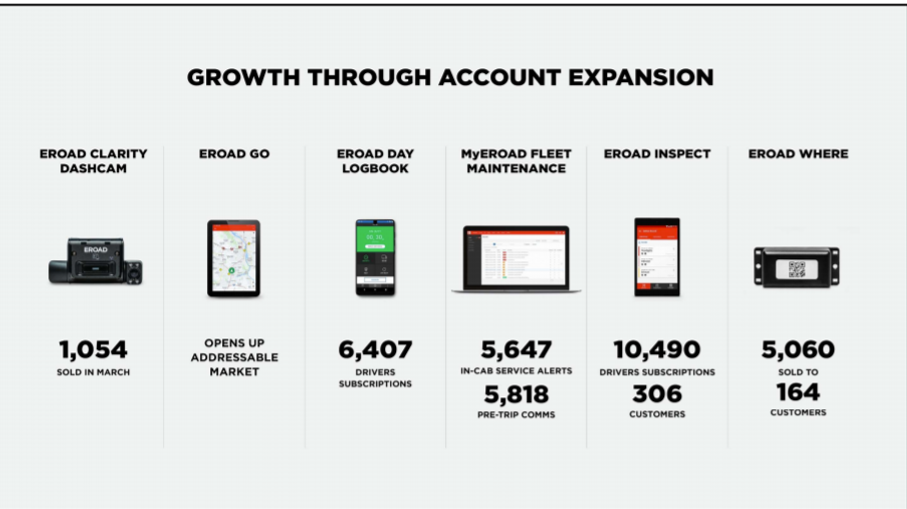

Eroad has a strong pipeline to grow the number of users over the short, medium and long term. They currently have two US enterprise customer prospects and a mix of mid market customer prospects in pilots underway or commencing shortly. This is in addition to Coretex’s extensive enterprise customer pipeline. In Australia, Eroad recently signed Ventia, a large enterprise customer and doubled the number of Australian users. In New Zealand, despite their dominance they continue to grow through sale of new products and non telematics solutions (see picture below for a comprehensive product list). For example, Eroad’s electronic logbook solution has seen strong growth from customers who are using a competitor’s telematics solution. This drives immediate unit sales, but also creates the opportunity to engage with the customer to and when the opportunity presents, become the telematics vendor as well. The new products and non telematics solutions also provide Eroad with an opportunity to sell more features to existing customers, and drive average revenue per user higher. Given the existing relationship with customers and fixed cost base, the higher average revenue per user will be at a higher margin. This can only be done because the company continues to invest in research and development.

Risks

Eroad has struggled to grow in North America, adding only 390 units in the most recent quarter compared to 2,855 in New Zealand and 907 in Australia. Over the last 12 moths, the company has grown 5% in North America, 13% in New Zealand and 78% in Australia. Eroad has 35,437 installed units in North America and Coretex has 47,625 and so combining the two companies will bring scale benefits, but they will remain a minnow in the industry. The company also announced that a large North American customer with 1,700 units will not be renewing their contract due to them being acquired by another company. Furthermore although the company grew during the pandemic, they were negatively affected, and sustained lockdowns and restrictions will temper their growth in the near term.

Valuation

The combined entity generated $131.1m of AMRR in FY21 and has 112.3m shares on issue giving it a market capitalisation of approximately $700m. This equates to a valuation multiple of approximately 5.4x trailing AMRR. Although there are many other factors we need to consider including liquidity, growth rate, retention rate, total addressable market, margin and competitive dynamics compared to other high growth software companies with recurring revenues, the valuation doesn’t appear to be excessive (Megaport trades at 30x, Xero at 23x, Nitro at 14x).

Sustainability

The company makes a positive contribution to the United Nations Sustainable Development Goals (11. Sustainable Cities and Communities, 13. Climate Action) through the software and hardware that they sell. Their devices have shown to increase the safety of drivers and the public and achieve greater fuel efficiency, reduce compliance costs and improve fleet productivity. Coretex’s specialised products also help improve efficiency and reduce waste, emissions and environmental contamination.

Eroad scores highly using our Sustainability Framework and using Impact Management Project’s classification system the company sits between a B Company (Benefits Stakeholders) and C Company (Contributes to Solutions).

This note has been prepared by ELM Responsible Investments (‘ELMRI’) ABN 70 607 177 711 AFSL 520428, for Australian wholesale clients for the purposes of section 761G of the Corporations Act 2001 (Cth).

The information is not intended for general distribution or publication and must be retained in a confidential manner. Information contained herein consists of confidential proprietary information constituting the sole property of ELMRI and its investment activities; its use is restricted accordingly.

This note is for general informational purposes only and does not purport to be comprehensive or to give advice. The views expressed are the views of the writer at the time of preparation and presenting and all forecasts, assumptions, opinions, data and other information are not warranted as to accuracy or completeness and are subject to change without notice. This is not an offer document and does not constitute an offer or invitation of investment recommendation to distribute or purchase securities, shares, units or other interests to enter into an investment agreement. No person should rely on the content and/or act on the basis of any material contained in this note. Any potential investor should consider their own circumstances and seek professional advice.

ELMRI funds, its directors, employees, representatives and associates may have an interest in the named securities.

Past performance is for illustrative purposes only and is not indicative of future performance.