ELM Responsible Investments Global Fund

Performance

As at 28 February 2025

| 3 months | 6 months | 12 months | Inception* | |

|---|---|---|---|---|

| ELMRI Global Fund | 0.15% | 15.9% | 17.3% | 29.9% |

| Global Equities Benchmark in AUD | 4.8% | 14.0% | 21.1% | 53.5% |

*The inception date of the ELMRI Global Fund is 15th October 2021

Our Purpose

The ELM Responsible Investments Global Fund is a concentrated portfolio of our best global ideas. We combine our Sustainability Framework with our Investment Framework to construct an ethical portfolio of companies that are facilitating the transition to a more sustainable world.

Through our Sustainability Framework we are guided by the United Nations Sustainable Development Goals, which we use to ensure companies are aligned with the most pressing challenges facing humanity. We then apply the Impact Management Project’s Five Dimensions of Impact, to prioritise those companies that are actively contributing to the solutions for these problems.

Our Investment Framework includes traditional financial models and analytical methods, with an emphasis on identifying high-quality companies by focusing on management and culture. We look to draw a road-map for how shareholder value could be created and realised by the market, identify sustainable long-term competitive advantages, and integrate analysis of each company’s financial performance and ESG integration.

Through this process, we identify a pool of possible investments and construct a portfolio of typically 10-30 companies, prioritising our highest-conviction ideas. We maintain a long-term investment horizon and behave like business owners, not stock traders.

Key Features of the Fund

Investment: Units in ELM Responsible Investments Global Fund, a fixed unit trust.

Objective: The Fund aims to outperform the Global Equities Index in Australian Dollars on a net of fees basis, by investing in companies that operate ethically, responsibly and sustainably.

Investment Manager and Trustee: ELM Responsible Investments Pty Ltd.

Investors: Wholesale and sophisticated investors only.

Benchmark: Global Equities Index in Australian Dollars.

Inception Date: 15 October 2021.

Suggested Investment Time Frame: 5+ years.

Base Fees: Management fees of 0.65%pa (+ GST) of the net asset value of the Fund, calculated and paid quarterly. Other expenses and indirect costs may apply.

Performance Fee: 25% (+ GST) of the Fund’s out-performance of the Benchmark subject to a high water mark.

We are proud that the ELM Responsible Investments Global Fund is a RIAA Certified responsible investment product, and has received the Sustainable Plus classification . Learn More.

The ELM Responsible Investments Global Fund has been certified and classified by the Responsible Investment Association Australasia according to the operational and disclosure practices required under the Responsible Investment Certification Program. See www.responsiblereturns.com.au and RIAA's Financial Services Guide for details.

The Responsible Investment Certification Program provides general advice only and does not take into account any person’s objectives, financial situation, or needs. Neither the Certification Symbol nor RIAA recommends to any person that any financial product is a suitable investment or that returns are guaranteed. Because of this, you should consider your own objectives, financial situation and needs and also consider the terms of any product disclosure document before making an investment decision. Certifications are current for 24 months and subject to change at any time.

Key Areas of Investment

Current Holdings

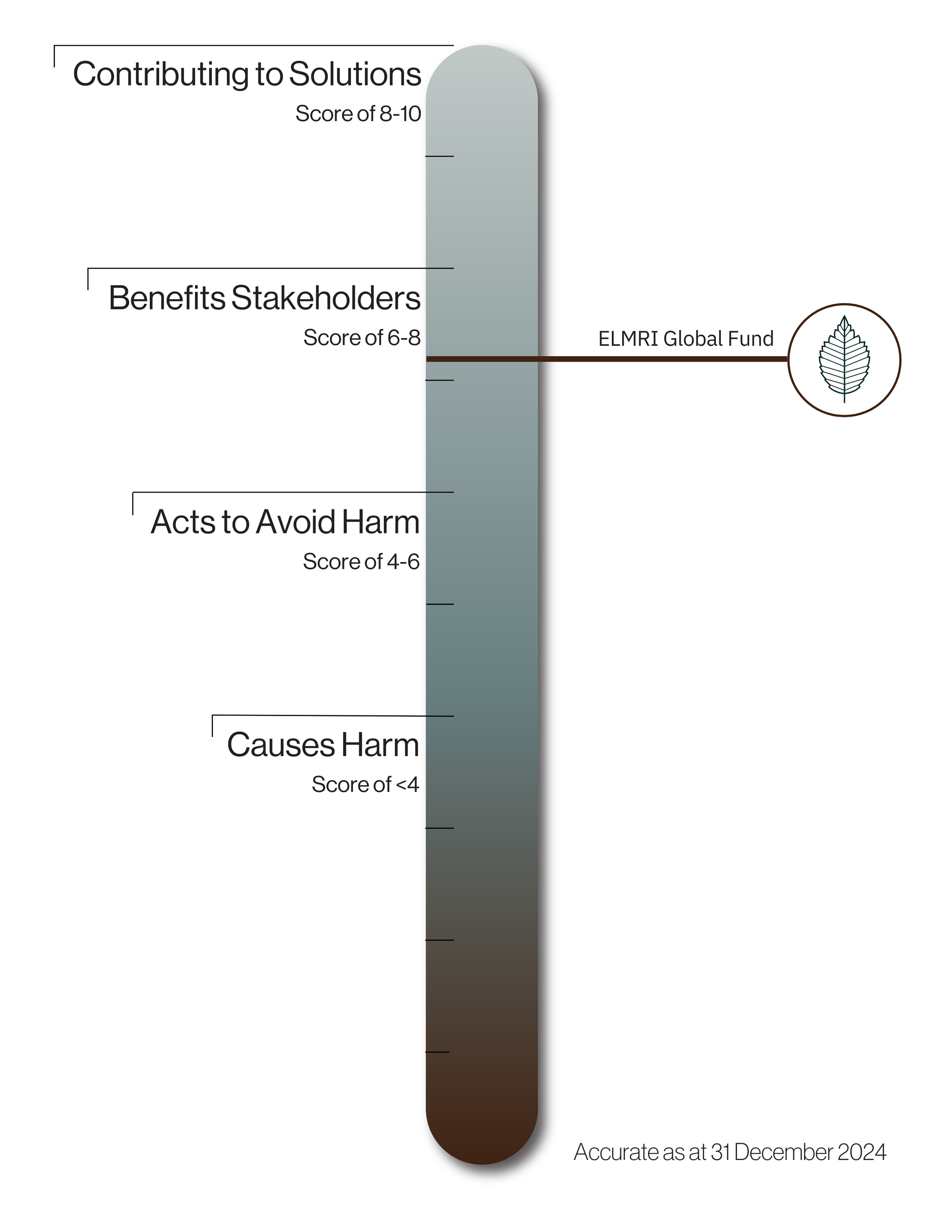

As part of our Sustainability Framework we assess each company using the Impact Management Project’s Five Dimensions of Impact classification system. For each company we assess the experience or effect stakeholders (consumers, employees, suppliers, the environment and broader society) have had and will have by engaging with the company, or as a consequence of the company. Each company is scored and classified as one of:

Causes Harm

Acts to Avoid Harm (A): Minimum obligations and requirements a company has to all stakeholders including their customers, staff, the environment and shareholders are met. These companies mitigate operational and reputation risk, but do not contribute to positive change. These companies are usually managing their ESG risk.

Benefits Stakeholders (B): These are companies that are actively benefiting stakeholders in addition to avoiding harm. Such companies may be offering an attractive working environment for staff, or converting their energy usage to renewable energy. B companies are generally motivated by financial out-performance over the long term, and often referred to as pursuing ESG opportunities.

Contributes to Solutions (C): These are companies that are contributing to solutions using their full capabilities. They tend to focus on finding solutions to pressing problems impacting the most under-served individuals.

Ideally we would invest exclusively in C companies making the biggest contribution to the UN SDGs. These companies, however, often represent higher investment risk as they tend to operate in difficult geographies addressing complex issues. We also need to ensure investment returns are acceptable, and build a balanced portfolio to deliver on our fiduciary duty to our clients. We construct profitable portfolios by investing primarily in B and C companies, as well as A companies, without the need to invest in companies that cause harm.

Our Portfolio Impact Score is produced by averaging the scores of every holding within the ELMRI Global Fund portfolio. While this inherently simplifies a huge amount of complex data into a single number, we believe it provides a useful ‘at-a-glance’ measurement of our authentic commitment to impactful investing. This score is updated quarterly in alignment with our Quarterly Holdings reporting.

To more deeply understand our sustainable investing principles and processes, we recommend current and prospective investors review our Impact Report.

Portfolio Impact

Principles

Our Responsible Investing Principles

Our Sustainability Statement provides a clear explanation of our principles, allowing you to assess whether our approach aligns with yours. Our ESG policy outlines how we engage with ESG issues. Our Controversial Industries Policy outlines the industries which we consider incompatible with our criteria, and how this factors into our negative screening process.

Voting and Engagement

Voting is a privilege and a responsibility. We vote in ways that align with our clients' long-term economic interests and sustainability goals. We also engage with companies, focusing on critical issues and areas needing improvement.

TCFD Report

TCFD developed a set of recommended climate-related disclosures for companies and financial institutions. These recommendations help investors, shareholders and the public better understand their climate-related financial risks.

Impact Report

Our Impact Report provides an in-depth explanation of our investing principles and process, and outlines our key investment themes and areas. The report includes a discussion of our holdings individually, outlining our analysis of their positive impact, as well as any engagement we have undertaken.

How To Invest

We are currently accepting new investors. The ELM Responsible Investments Global Fund is available to wholesale and sophisticated investors only, and there is a minimum initial investment of $100,000.

Currently you have the option of investing directly with us (through our fund administrator) or using an investment platform on which the ELM Responsible Investments Global Fund is listed.

Invest Directly

You can invest directly through the application portal, accessed via the ‘Invest Now’ button below. If you would like a paper copy of the application form, please email us at info@elmri.com and we will arrange for one to be sent to you.

Please ensure you have read our Information Memorandum (“IM”), which outlines key details and dates in the applications process.

Invest through a Platform

The ELM Responsible Investments Global Fund is available on the following investment platforms:

Mason Stevens

NetWealth