Tesla - shareholder and environmental benefits

Background

Tesla has two key operating segments, Tesla Motors and Tesla Energy. Tesla Motors designs, manufactures and leases industry leading, high performance electric vehicles (EV). Tesla Energy is the clean energy subsidiary of the company, and develops, builds, installs and sells solar panels, battery energy storage products, and other related products and services including software solutions.

Tesla Motors

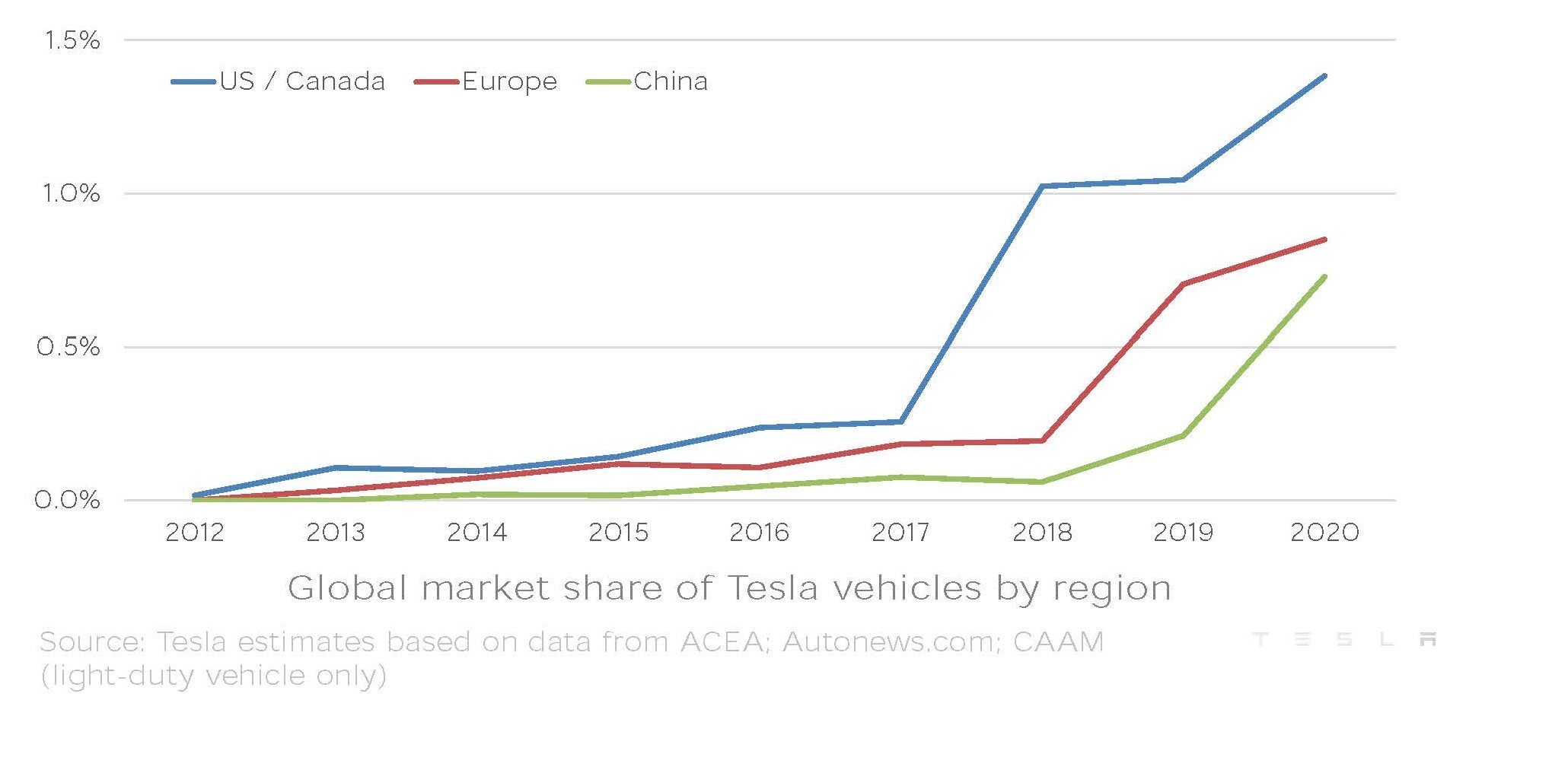

In the Tesla Motors segment, the company has numerous competitive advantages including cost, thanks to its superior engineering capability, vertically integrated model, single focus on EV and first mover advantage. Compared to other brands, Tesla has the longest range and also the fastest acceleration (compared to both internal combustion engine vehicles and electric vehicles). Other features include recharging capability from almost any available electrical outlet, fast charging capability from its superchargers, superior autopilot system, over the top software upgrades and lower ownership costs through lower fuel and maintenance costs as well as higher resale value. Despite these benefits and superior performance, Tesla still has <1.5% market share in US and Canada and <1% market share in Europe and China, suggesting that there is potential for significant market share gains.

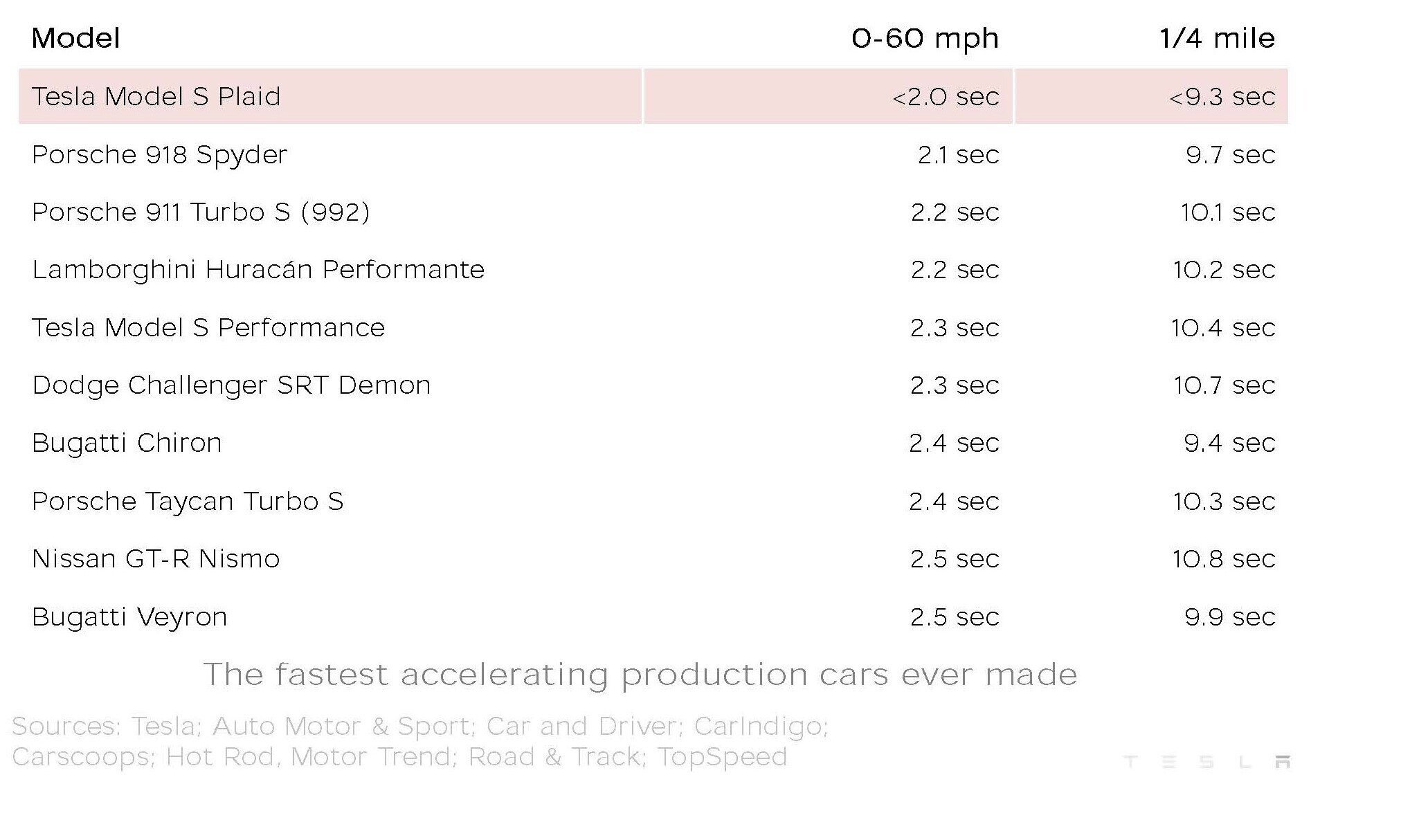

Tesla’s superior acceleration performance compared to all other vehicles

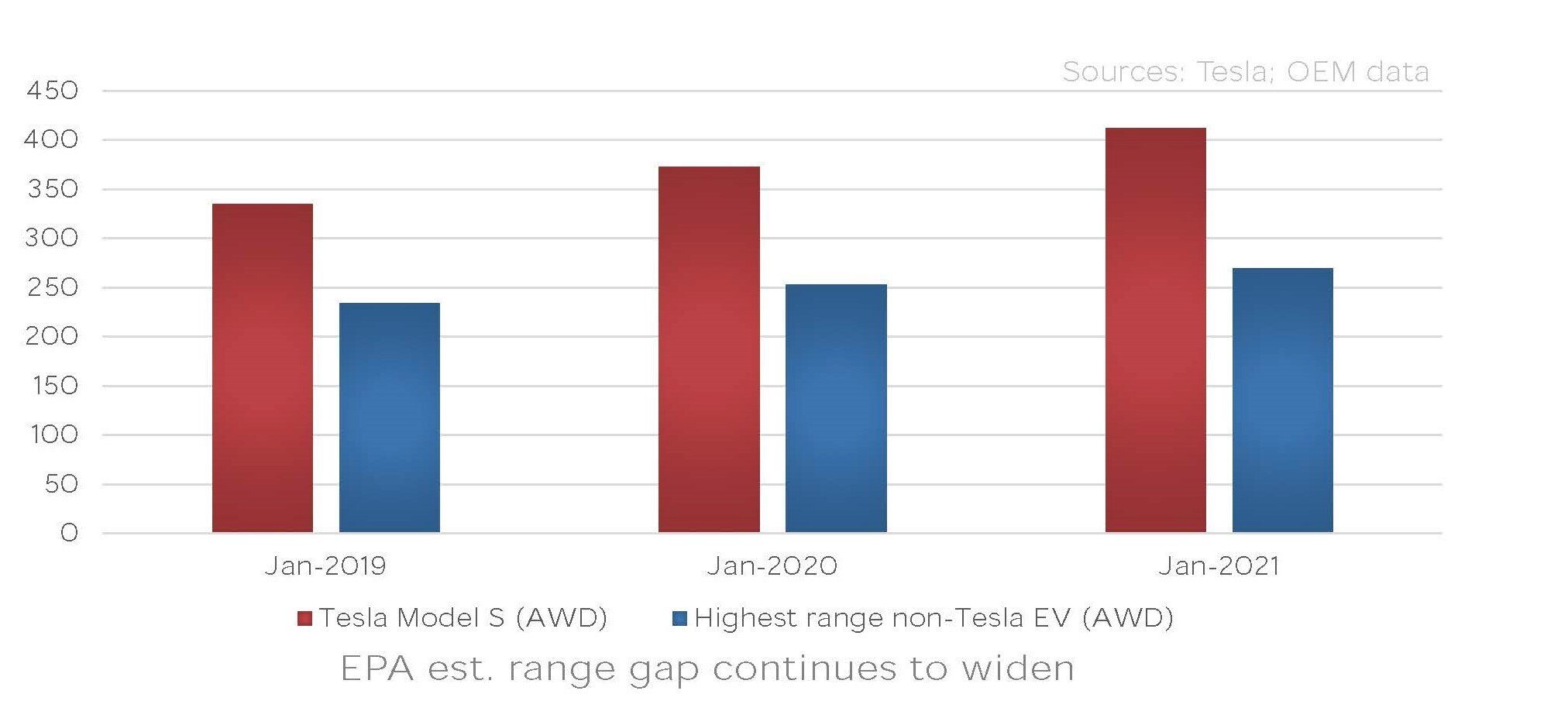

Telsa’s superior battery range compared to other EV

Significant growth potential, with Tesla’s market share only <1.5%

Although we expect competition to increase with all traditional auto manufacturers entering the EV market, we think Tesla will remain the leader in this space. We have seen from other industries that underwent significant disruption, it is incredibly difficult for incumbent companies to pivot and invest in new technology and products that are likely to cannibalise their existing revenue stream. We think this has been the case for traditional auto manufacturers, and the lead Tesla already has over them will be difficult to eliminate.

There is a good probability that the company reaches 20 million vehicle sales per annum within the next 10 years, as the share of EV increases and as they expand the breadth and depth of products including expanding into commercial vehicles such as trucks.

To put this into context total global new car sales is approximately 70 million units per annum with the two largest auto manufacturers today being Volkswagen and Toyota, selling approximately 10 million vehicles per annum each. In 2020, Tesla produced and delivered half a million vehicles and generated over $27 billion in sales at a gross profit margin of 25.6%. If they do in fact reach 20 million units in the next 10 years, then they can generate $600 billion in sales and $200 billion in gross profit. The target of 20 million units requires significant growth and market share gains, but given the competitive advantages the company possess, we think it is a realistic target over the long term.

Benefits of Data

Over the years, Tesla has been collecting vast amounts of driving data giving them an advantage when it comes to developing and obtaining regulatory approval for fully autonomous vehicles. The revenue potential and social impact is significant as Tesla can revolutionise the transport industry by offering a fully autonomous fleet of EV taxis either through a subscription or on demand model. According to McKinsey, this market is estimated to be worth trillions of dollars.

Tesla’s insurance business will also benefit from the data the company collects, allowing them to price risk much more efficiently and provide savings back to customers. As the manufacturer, repairer and insurer, Tesla can use the repair cost insights to modify and improve their manufacturing process further enhancing their customer value proposition. The total global addressable market for personal auto insurance is significant at $750 billion.

Tesla Energy

Tesla Energy is the only vertically integrated energy company, providing production (solar), consumption/storage (EVs), storage (Powerwalls, Megapacks), and software (Autobidder). This vertical integration provides Tesla with strong competitive advantages in terms of intellectual property, customer insights and convenience. They are able to develop superior industry leading products at a lower cost, innovate and commercialise new technologies at speed, and leverage the single ecosystem to develop connected products, delivering convenience to end consumers.

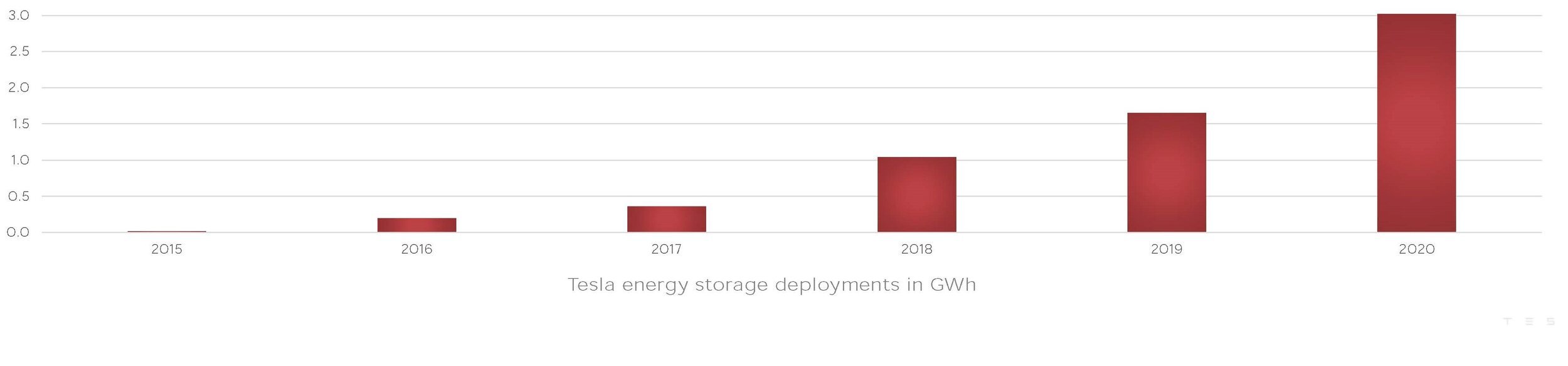

It is becoming widely accepted that in order to adhere to the Paris Agreement, and limit global warming, all fossil fuel based power generation must be converted to renewable energy sources such as wind and solar. Due to the complexity of this transition, and more specifically the intermittent nature of renewable energy and the volatility associated with it, storage solutions and management systems such as the ones developed by Tesla will see strong growth (see chart below for recent growth trends) and be integral to the successful transition to renewable energy.

Conclusion

Tesla is one of the most innovative companies in the world, developing solutions to tackle the climate crisis by revolutionising the automobile and energy sectors. They possess numerous competitive advantages, and have multiple growth opportunities as they drive the transition to a fossil free future.

This note has been prepared by ELM Responsible Investments (‘ELMRI’) ABN 70 607 177 711 AFSL 520428, for Australian wholesale clients for the purposes of section 761G of the Corporations Act 2001 (Cth).

The information is not intended for general distribution or publication and must be retained in a confidential manner. Information contained herein consists of confidential proprietary information constituting the sole property of ELMRI and its investment activities; its use is restricted accordingly.

This note is for general informational purposes only and does not purport to be comprehensive or to give advice. The views expressed are the views of the writer at the time of preparation and presenting and all forecasts, assumptions, opinions, data and other information are not warranted as to accuracy or completeness and are subject to change without notice. This is not an offer document and does not constitute an offer or invitation of investment recommendation to distribute or purchase securities, shares, units or other interests to enter into an investment agreement. No person should rely on the content and/or act on the basis of any material contained in this note. Any potential investor should consider their own circumstances and seek professional advice.

ELMRI funds, its directors, employees, representatives and associates may have an interest in the named securities.

Past performance is for illustrative purposes only and is not indicative of future performance.