Ethical Investment May 23 Report

Dear Investor

I wanted to inform you about some changes to the format of our newsletters. Moving forward, we have decided to provide you with more stock-specific and hopefully more insightful content as opposed to providing an update of market events and returns which you can obtain from other sources. Our goal is to provide you with a better understanding of our investment strategies and the opportunities we see.

Additionally, we have decided to combine the newsletters of both the ANZ Conviction Fund and Global Fund. This decision was made because of the overlap and similarities in our strategies. By doing this, we aim to deliver a unified message on important topics such as macroeconomics, investments, investment themes, and sustainability. Both our ANZ and Global Funds are impacted by these topics in similar ways, and we believe it would be helpful to discuss both global and domestic companies with you. There are valuable learnings to be gained from both perspectives.

We hope this new format will be easier to read, more insightful, and useful. However, we are always open to improving our communication, so please feel free to provide any feedback you may have.

Investment Performance

The ANZ Conviction Fund gained 0.1% in May, bringing the returns for 2023 to 12.6%. Since its inception on October 10, 2019, the fund has generated returns of 19.2%.

The Global Fund delivered a 7.5% return in May, resulting in a 22.1% return for 2023. Since its inception on October 15, 2021, the fund has seen returns of -12.8%.

Please note, official performance figures will be released in the June 2023 Quarterly Report.

NVIDIA, AI and Machine Learning

NVIDIA recently released their quarterly earnings report, causing their stock to surge by over 25%. This company has been one of the best performers in 2023. The advancements in AI and Machine Learning have captured the world's imagination, and more companies are now incorporating these technologies into their operations to enhance customer service and productivity.

At first glance, NVIDIA's stock price increase may appear excessive. However, considering the stock was not heavily shorted and earnings exceeded Wall Street estimates by 50%, the stock is actually cheaper today based on short-term metrics such as Enterprise Value / Sales and Enterprise Value / EBITDA ratios than it was before the report (see chart below). Furthermore, the company provided exceptionally strong guidance for the upcoming quarter.

Source: Refinitiv

Historically, NVIDIA gained recognition for supplying Graphic Processing Units (GPUs) to the gaming industry, ensuring high-quality graphics for entertainment purposes. However, we recognized that GPUs held potential beyond gaming and had the capacity to facilitate advancements in other crucial sectors. We witnessed a glimpse of this potential when health technology company and a large holding in our ANZ Fund, ProMedicus relied on GPUs to deliver their technology and improve healthcare outcomes.

As the mainstream adoption of AI continues to grow, the importance of GPUs is poised to escalate even further. NVIDIA's high-powered chips play a critical role in running AI models, which have the potential to revolutionize industries across the board. Anticipating the exponential growth in AI adoption, NVIDIA estimates that over the next decade, there will be a need to upgrade $1 trillion worth of legacy chips in data centers worldwide to NVIDIA's GPUs. It is worth noting that GPUs not only outperform legacy chips but also offer higher energy efficiency, making them an attractive choice for the industry.

How are we invested for the AI boom

In our Global Fund, we have consistently allocated a significant portion to a theme called "Future Technology," which includes investments in NVIDIA, ASML, and On Semi. In our previous report, we discussed ASML, a provider of highly advanced machines used in semiconductor manufacturing. On Semi, on the other hand, specializes in producing semiconductors for the electric and autonomous vehicle industries, as well as renewable energy.

Tesla, the largest holding in our Global Fund can also be seen as an AI company due to its endeavours in developing autonomous vehicles. Tesla has even developed its own supercomputer called Tesla Dojo to support its autonomous vehicle ambitions.

Looking beyond this, client-facing software companies are well placed to monetize this technology. Established companies with valuable data assets operating in large, inefficient industries, and led by forward-thinking management teams are particularly well-positioned. Examples of such companies include ServiceNow, Workday, and Microsoft. They work with businesses of all sizes, assisting them in digitizing their workflows and enhancing productivity. We think these companies are well placed to grow over the next decade.

However, the most impactful and exciting areas of investment today lie at the intersection of healthcare and technology. Companies like Moderna and Gingko Bioworks are utilizing data and AI to develop ground-breaking vaccines and life-saving drugs. Moderna has become a household name, and its value lies not only in its COVID-19 vaccines but also in its ability to employ AI to increase the success rate of developing new vaccines. We eagerly await their vaccines for Zika, flu, HIV, and other diseases.

Gingko Bioworks, although not as well-known as Moderna, is a synthetic biology company whose foundries design, construct, and test organisms on a large scale. They possess a growing codebase of cells, enzymes, and genetic programs, enabling their engineers to accelerate new projects and make discoveries in drugs and compounds in a shorter timeframe. As Gingko Bioworks' codebase continues to expand, their algorithm will improve, leading to further advancements in important industries such as healthcare and sustainable agriculture.

ProMedicus has been investing in this field for many years. The company recognized the importance of data early on and, in 2021, announced a collaboration with the Mayo Clinic to facilitate the development and commercialization of AI products for medical imaging. Their Visage 7 platform is optimized for AI, allowing algorithms to be seamlessly integrated into clinicians' desktops with the aim of enhancing patient outcomes. Like ProMedicus, companies like Xero and Seek are well-positioned to leverage the extensive data they have gathered over the years to develop products that ultimately benefit small business owners (in the case of Xero) and enhance the job-seeking experience and hiring process (in the case of Seek).

Ethics of AI

All new technologies, including AI, possess the potential for both positive and negative impacts. However, the remarkable potential and power of AI make the consequences of its misuse particularly alarming. Therefore, it is crucial to engage in discussions about regulation and establish safeguards. For instance, companies like Palantir primarily utilize data and AI for military purposes. We choose not to invest in such companies.

On the other hand, we have strategically positioned our portfolio towards companies that invest in AI capabilities to promote positive changes in society and the environment. I firmly believe that there are numerous exciting opportunities to leverage AI in impactful areas, as I mentioned earlier.

Macroeconomics

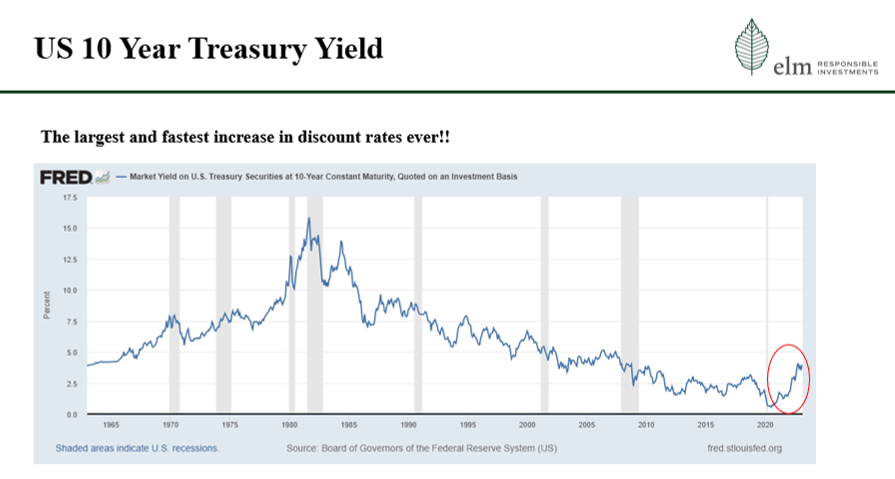

Despite the strong operational performance of many of our companies, our strategy faced challenges in 2022. The primary cause for this setback was the exceptional rise in inflation and interest rates. As depicted in the slide below, we witnessed the fastest pace of interest rate increases ever recorded.

Source: Fred St Louis Fed

However, for long-term investors, the crucial question is whether the macroeconomic conditions experienced in 2022 were merely an anomaly or indicative of a structural shift in our economy. Our belief is that it was an anomaly, and we anticipate that the market will once again recognize the value of innovative, sustainable growth companies that drive positive change.

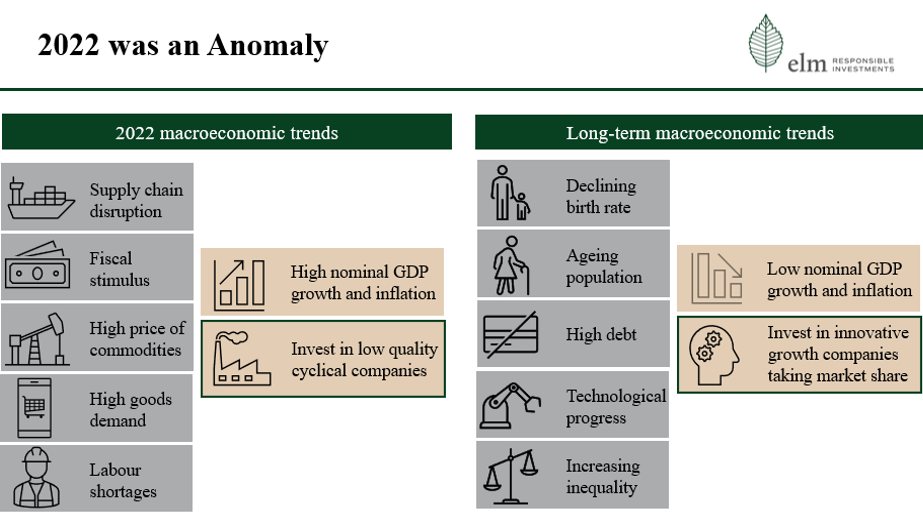

In the slide below, from a recent presentation, we can observe that 2022 was an exceptional year marked by supply chain disruptions, unprecedented fiscal stimulus, elevated commodity prices, strong demand for goods, and labour shortages. These one-time shocks resulted in high nominal GDP growth and inflation, which favoured low-quality cyclical companies. Nevertheless, when considering the long-term outlook, I firmly believe that the structural forces of declining birth rates, an aging population, high debt levels, technological advancements (particularly AI and machine learning), and growing inequality will contribute to lower nominal GDP growth and inflation, which we are slowly starting to see in our economies.

Despite the strong performance of our portfolios in 2023, we believe that the valuations of our companies remain depressed, with a clear opportunity for strong future returns. This view is reinforced by the changing macroeconomic conditions that are starting to align with our investment style, as well as the accelerating operational performance of our companies. Specifically, we have observed significant progress in the areas of healthcare digitization, overall economic digitalization, electric vehicle adoption, and the uptake of renewable energy. These factors contribute to our belief that the internal rates of return of our portfolios remain highly attractive for our investors.

If you would like to arrange a time to discuss this matter in more detail, please click here to schedule a meeting. Alternatively, if you are interested in investing with us, you can access our investment portal and review our fund documentation by clicking on the "Invest" buttons below. Otherwise, please feel free to respond to this email, and we will promptly get in touch with you.

Thank you for your support and interest.

Kind regards

Jai

ELMRI Global Fund

Top Holdings

Tesla

ServiceNow

Microsoft

ASML

NVIDIA

Key Areas of Investment

Electric Vehicles, Healthcare Equipment, Property & Infrastructure, Software & Services, Biotechnology & Future Health, Environment & Renewable Energy, Fintech & Marketplace, Data & Research, Medical Devices, Future Technology

ELMRI ANZ

Conviction Fund

Top Holdings

Xero

Infratil

ProMedicus

CSL

ResMed

Key Areas of Investment

Renewable Energy, Employment & Education, Software & Services, Biotechnology, Medical Devices, Digital Wallets, Health Technology, Property & Social Infrastructure, Housing & Sustainable Building Products

This note has been prepared by ELM Responsible Investments (‘ELMRI’) ABN 70 607 177 711 AFSL 520428, for Australian wholesale clients for the purposes of section 761G of the Corporations Act 2001 (Cth).

The information is not intended for general distribution or publication and must be retained in a confidential manner. Information contained herein consists of confidential proprietary information constituting the sole property of ELMRI and its investment activities; its use is restricted accordingly.

This note is for general informational purposes only and does not purport to be comprehensive or to give advice. The views expressed are the views of the writer at the time of preparation and presenting and all forecasts, assumptions, opinions, data and other information are not warranted as to accuracy or completeness and are subject to change without notice. This is not an offer document and does not constitute an offer or invitation of investment recommendation to distribute or purchase securities, shares, units or other interests to enter into an investment agreement. No person should rely on the content and/or act on the basis of any material contained in this note. Any potential investor should consider their own circumstances and seek professional advice.

ELMRI funds, its directors, employees, representatives and associates may have an interest in the named securities.

Past performance is for illustrative purposes only and is not indicative of future performance.