Orsted – investing in renewable energy

Company Overview

Orsted is a global renewable energy company that develops, constructs and operates offshore and onshore wind farms, solar farms and energy storage facilities. They are an industry leader as the largest offshore wind developer by installed capacity, and emerging as one of the leading onshore renewable companies. Looking forward, Orsted’s growth strategy is to become the world’s leading green energy company through three distinct business division, 1) offshore wind farms, 2) onshore wind farms, solar farms and energy storage, and highly complementary 3) renewable hydrogen and green fuels. All three of Orsted’s growth pillars have strong structural tailwinds, being essential elements in achieving net zero emissions by 2050, and are also the most impactful, targeting the sectors with the largest emissions.

Offshore Wind – Beginning of S-Curve

In any of the scenarios outlined by the major climate thinktanks, achieving net zero carbon emissions by 2050 requires rapid scaling of investments in renewable energy supply and infrastructure. Bloomberg New Energy Finances (BloombergNEF) estimates that annual investment will need to at least double from US1.7T pa today, to between $3.1 and $5.8 trillion per year on average over the next three decades. This will create enormous opportunities in the markets where Orsted currently has a market leading position, such as the UK, US, Germany, Taiwan and northern Europe.

Offshore wind projects are the primary way to achieve large-scale renewable generation projects and are well suited to energy giants, as offshore projects are often GW-scale projects, as opposed to MW-scale for onshore. While offshore has traditionally been more capital intensive per MW produced, levelised costs of production are coming down as turbines get bigger.

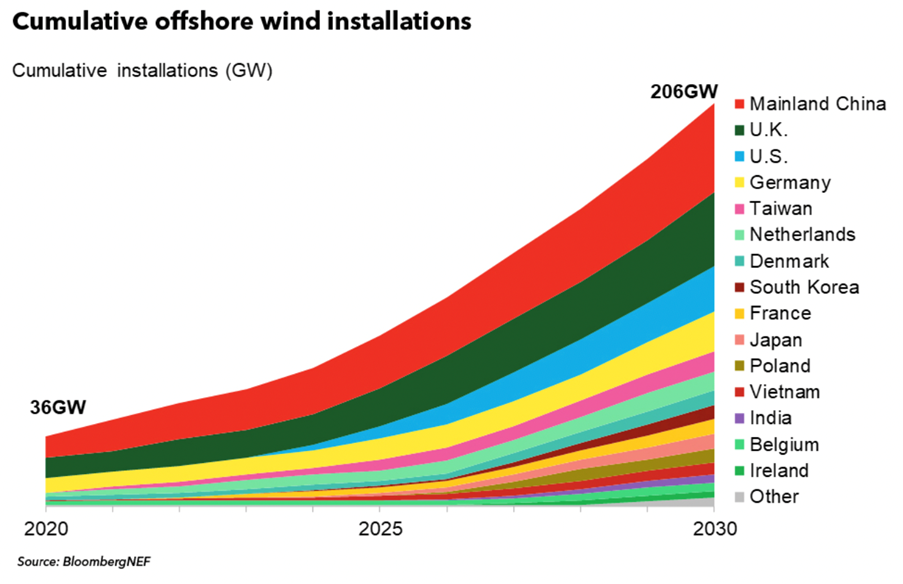

As the chart below demonstrates, offshore wind is hitting an inflection point and we believe we are seeing the beginning of the s-curve, which provides continued growth opportunities beyond 2030 and allow Orsted to be selective in choosing value-creating projects.

For context on the growth of its offshore business alone, Orsted’s current growth strategy will see its installed base grow ~4x from 7.6GW in 2021, to 30GW in 2030.

Onshore Platform – Scaling Rapidly

Onshore renewable developments are supported by the same global structural tailwinds and are forecast to account for an even larger investment spend than offshore, despite the lower capital costs. This is due to the sheer volume of onshore capacity projected to be installed over the next decade. As an example, the onshore capacity expected to be built in the US alone is forecast at 200GW by 2030, which is similar to the entire global offshore capacity forecast to be installed by 2030.

BNEF New Energy Outlook 2020 – includes both utility and small-scale solar PV and batteries

Orsted’s onshore capacity has scaled rapidly since 2018, growing almost six-fold, and they have a proven track record of scaling new renewable technologies. Their pipeline of projects are in desirable markets of the US and Europe, both of which are forecast to have the largest new installations (ex-China) in the coming decade.

Hydrogen

BloombergNEF estimates that the three quarters of emissions reductions needed to reach net zero will come from decarbonising energy generation. However, in order to enable the decarbonisation of hard-to-abate sectors, such as displacing fossil-fuel combustion in industry and heavy transport, large-scale renewable hydrogen and green fuels production will be required.

Orsted is competitively positioned to participate in the growing demand for green hydrogen due to its large-scale generation assets being in proximity to large offtake partners, such as industrial clusters in Europe. This should provide Orsted with potential for synergies and cost advantages as offshore wind is well suited to electrolyser capacity due to strong wind and electricity generation.

Conclusion

Orsted’s market leading position, scale and industry experience puts them at a considerable competitive advantage to capture the huge growth in large scale projects forecast to be developed over the coming decades. Furthermore the company’s large scale offshore wind capacity positions it to become a leading global renewable hydrogen producer, a commodity that is forecast to have a large impact on hard-to-abate sectors and their ability to reach net zero by 2050.

This note has been prepared by ELM Responsible Investments (‘ELMRI’) ABN 70 607 177 711 AFSL 520428, for Australian wholesale clients for the purposes of section 761G of the Corporations Act 2001 (Cth).

The information is not intended for general distribution or publication and must be retained in a confidential manner. Information contained herein consists of confidential proprietary information constituting the sole property of ELMRI and its investment activities; its use is restricted accordingly.

This note is for general informational purposes only and does not purport to be comprehensive or to give advice. The views expressed are the views of the writer at the time of preparation and presenting and all forecasts, assumptions, opinions, data and other information are not warranted as to accuracy or completeness and are subject to change without notice. This is not an offer document and does not constitute an offer or invitation of investment recommendation to distribute or purchase securities, shares, units or other interests to enter into an investment agreement. No person should rely on the content and/or act on the basis of any material contained in this note. Any potential investor should consider their own circumstances and seek professional advice.

ELMRI funds, its directors, employees, representatives and associates may have an interest in the named securities.

Past performance is for illustrative purposes only and is not indicative of future performance.